Wells Fargo checking accountsWells Fargo has five different options for personal checking accounts — Everyday, Preferred, Portfolio, Teen and Opportunity. Businesses can select from Simple, Choice Platinum and Analyzed checking accounts. Most personal and business checking accounts require a $25 deposit to open.Wells Fargo savings accounts and CDsWells Fargo offers two savings account options, Way2Save and Platinum Savings. Wells Fargo also offers CDs, which require at least a $2,500 minimum opening deposit. CDs are available at fixed rates and step rates.Wells Fargo loansWells Fargo offers multiple loan types, including student loans, auto loans and mortgage loans to help you buy, refinance or renovate a home.

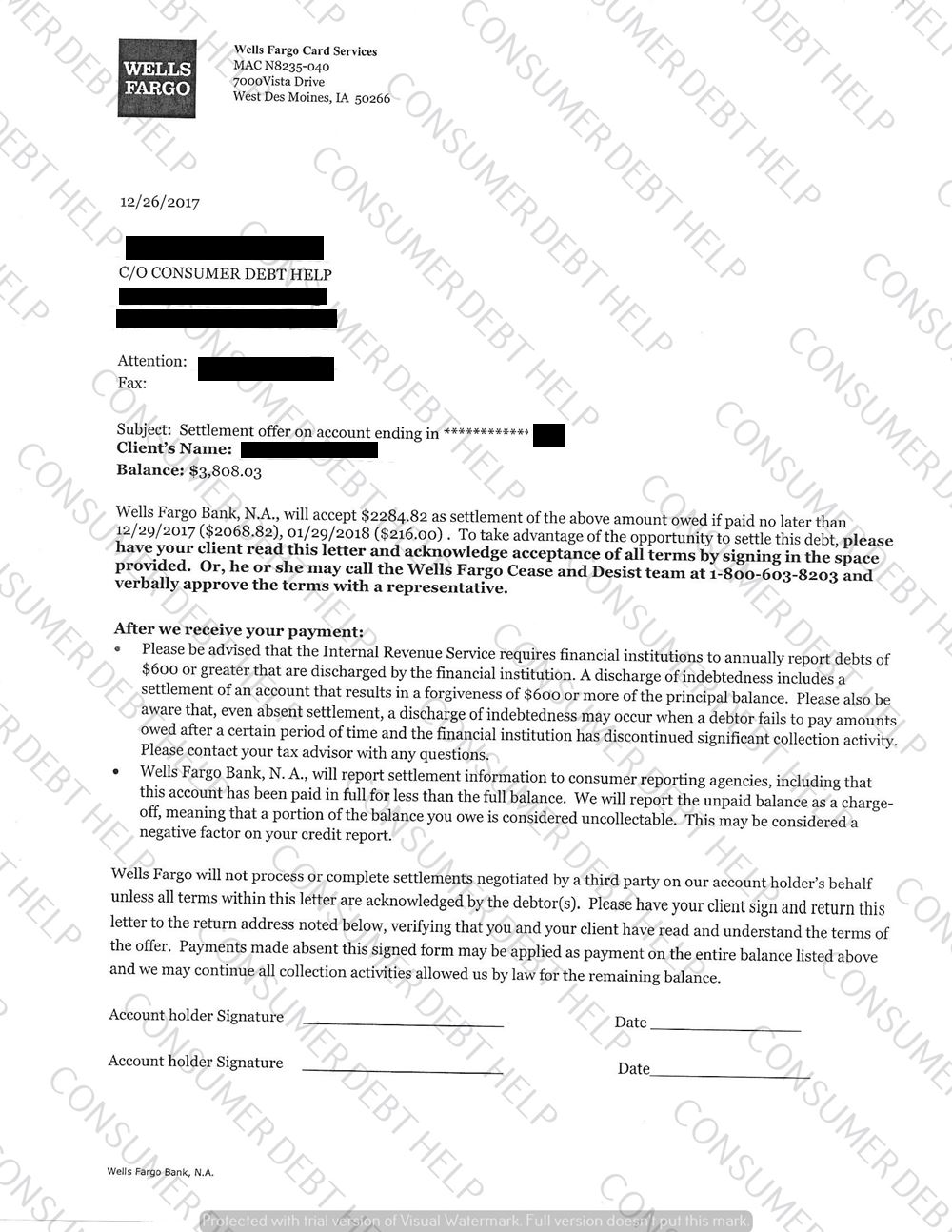

The bank offers low-APR personal loans and lines of credit ranging from $3,000 to $100,000. Wells Fargo also provides loans and lines of credit for businesses.Wells Fargo credit cardsWells Fargo has several credit card options. Almost all Wells Fargo cards have a cash back or reward program, and a few have no annual fee.Wells Fargo retirement servicesWells Fargo offers traditional and Roth IRAs. You can also invest in mutual funds and manage your portfolio yourself or with the help of a Wells Fargo investment professional. The WellsTrade Mutual Fund Screened Listed makes investing simple by pre-screening mutual funds. Wells Fargo Advisors, a full-service brokerage, is available to customers to help with investment planning.

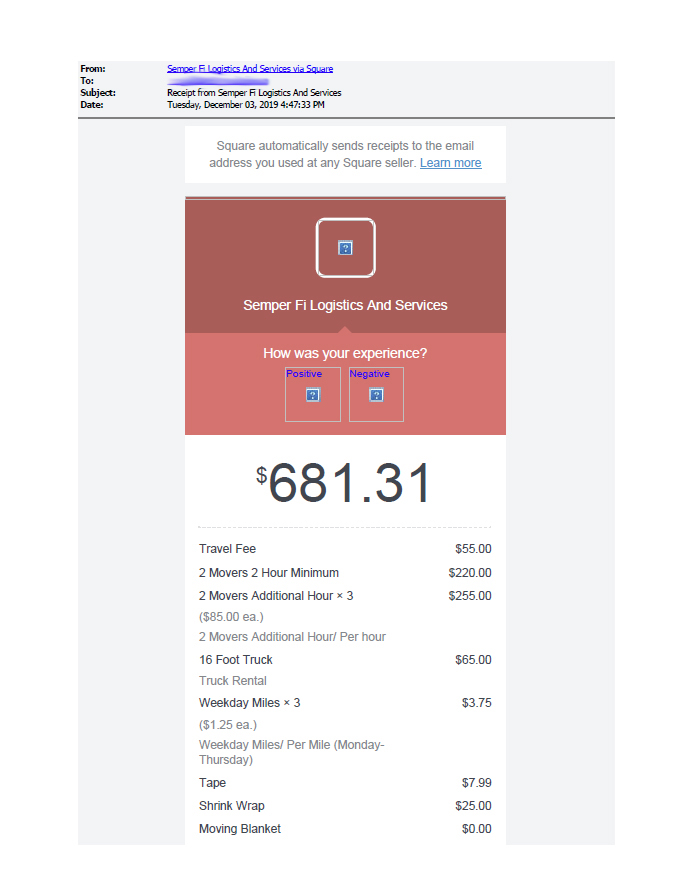

Mobile payments are available for Apple Pay, Google Pay and Samsung Pay. Wells Fargo benefits for business owners also include Clover point-of-sale systems customized fit your business needs. Wells Fargo products include banking, credit cards, loans, auto loans, student loans, home equity loans, home mortgage, life insurance health insurance, renters insurance, home and property protection, mutual funds, and more. Wells Fargo's credit cards include Rewards Card, Cash Back Card, Home Rebate Card, Platinum Card, Cash Back College Card, College Card and Secured Card. For checking accounts there is Value Checking account, College Combo, Custom Management Package, Complete Advantage Package and PMA Package.

Most of the checking accounts offer a platinum debit card, free access to online banking, mobile banking, account alerts, online bill pay and more. Wells Fargo's monthly service fees for checking accounts range from $0 to $30, though service fees are waived for teenagers and college students between 17 to 24 years old. Monthly service fees for business checking accounts range from $10 to $40. The bank charges a $5 or $12 monthly fee on savings accounts. Wells Fargo's checking account fees can be avoided by maintaining a specific average balance or completing a minimum number of transactions each month.

Also, expect fees for late credit card payments and overdraft charges unless your checking and savings accounts are linked. Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®.

The Request feature within Zelle® is only available through Wells Fargo using a smartphone. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement.

Your mobile carrier's message and data rates may apply. Wells Fargo also touts the use of your Way2Save account as a method of overdraft protection for customers who also have checking accounts. If you sign up for this optional service, Wells Fargo will transfer money from your Way2Save account into your checking account to cover an overdraft. However, this service doesn't prevent you from being charged a $12.50 overdraft fee once per business day.

The fee can be avoided if a covering transfer or deposit is made on the same business day. Wells Fargo offers many options to handle your financial needs, including checking and savings accounts, credit cards, investments and loans. Compared to other banks, interest rates and fees are average.

Overall, Wells Fargo's products and services are robust and allow you the convenience to bank however and wherever you like. If you choose to link your account to your Wells Fargo checking account for Overdraft Protection, please note the following. Depending on your account terms, an Overdraft Protection Advance Fee may be charged to your account each day an Overdraft Protection Advance is made, and interest will accrue from the date each advance is made. Your credit card must be activated; if it is not activated, no money will transfer to cover the overdraft.

Once your credit card has been activated, please allow up to 3 business days for your Overdraft Protection service to be fully enabled. Refer to the Consumer Credit Card Customer Agreement and Disclosure Statement for details. There may be other options available to protect against overdraft that may be less costly. For additional information on Overdraft Protection using your credit card, please visit /credit-cards/features/overdraft-protection. For details on other options, please visit /checking/overdraft-services/.

If applicable on your account, these monthly fees are in addition to your monthly service fee. A key part of Wells Fargo's business strategy is cross-selling, the practice of encouraging existing customers to buy additional banking services. Customers inquiring about their checking account balance may be pitched mortgage deals and mortgage holders may be pitched credit card offers in an attempt to increase the customer's profitability to the bank. Other banks have attempted to emulate Wells Fargo's cross-selling practices .

In September 2016, Wells Fargo was issued a combined total of $185 million in fines for opening over 1.5 million checking and savings accounts and 500,000 credit cards on behalf of customers without their consent. The scandal was caused by an incentive-compensation program for employees to create new accounts. It led to the firing of nearly 5,300 employees and $5 million being set aside for customer refunds on fees for accounts the customers never wanted. Carrie Tolstedt, who headed the department, retired in July 2016 and received $124.6 million in stock, options, and restricted Wells Fargo shares as a retirement package. Wells Fargo provides banking, investment and mortgage services as well as commercial and consumer financing at 7,600 locations in 32 countries and territories around the globe.

Wells Fargo mobile banking gives customers the ability to link their checking, savings, credit card and investment accounts all in one place. Customers can also deposit checks from their phones with the Wells Fargo app. Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off.

For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area.

Your mobile carrier's messaging and data rates may apply. Offers various advisory and fiduciary products and services including discretionary portfolio management. Wells Fargo affiliates, including Financial Advisors of Wells Fargo Advisors, a separate non-bank affiliate, may be paid an ongoing or one-time referral fee in relation to clients referred to the bank. The bank is responsible for the day-to-day management of the account and for providing investment advice, investment management services and wealth management services to clients.

The role of the Financial Advisor with respect to the Bank products and services is limited to referral and relationship management services. Wells Fargo check cashing feeYou only have to pay a Wells Fargo Bank fee to cash a check if you don't have an account. Outside of the U.S., ATM cash withdrawals are $5 each and ATM accounts transfers are $2 per transfer.Wells Fargo cash advance feeWells Fargo's cash advance fees are up to $12.50 per transaction.

You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo credit card. You might also be able to lower your overall monthly payments and turn multiple bills into one easy payment. Customers looking for a well-established and well-rounded financial institution may do well with Wells Fargo. Not only does this bank possess a large geographic footprint, but it also has every type of account, product and service you may need — a true one-stop banking shop.

Add in the fact that you can enjoy some relationship bonuses for linking multiple accounts or products under the Wells Fargo umbrella and this institution is a clear winner for anyone who values efficiency and streamlined banking experience. That said, Wells Fargo has not yet earned back the public's trust after the revelations from 2016 to 2018, of a series of systemic fraudulent practices that victimized its own clients for nearly two decades. Wells Fargo Business Online provides access to both your business and personal accounts online. With access to Wells Fargo Business Online, you have a convenient and secure way to manage your finances — review and transfer funds between your Wells Fargo accounts, view statements and check images, request stop payments, and much more.

Turning off your debit card is not a replacement for reporting your card lost or stolen. Turning your card off will not stop card transactions presented as recurring transactions; transactions using other cards linked to your deposit account; or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the debit card will also be turned off. Availability may be affected by your mobile carrier's coverage area.

Your mobile carrier's message and data rates may apply. Private label credit cards issued by Wells Fargo Bank, N.A. May not be eligible for all products and services listed here. Issued private label credit cards are typically merchant or industry branded credit cards that consumers apply for through a merchant or service provider. If you are unsure who your credit card issuer is, please consult your cardholder terms or your billing statement.

Call your cellular provider and request to set up automatic payments. Setting up automatic payments is not required to qualify for the Cellular Telephone Protection benefit; however, you need to pay your monthly cell phone bill with your eligible Wells Fargo Consumer credit card to get up to $600 protection. Wells Fargo has something for all small business, including business credit cards, loans and lines of credit. Visit Wells Fargo online or visit a store to get started. Wells Fargo offers the standard customer service benefits you'd expect with a bank of this size.

That includes the option to manage your account over the phone, online, via mobile banking, at an ATM, or a branch location. It also offers the option to live chat with customer service agents. Though it's a savings account, you have the ability to write checks from this account as long as you have the sufficient funds in the account.

You can also link this account to a regular Wells Fargo checking account for overdraft protection. Another savings encouragement is the Save As You Go® transfer, which moves $1 from your Wells Fargo checking account to your Way2Save account with each qualifying transaction. These transactions include any non-recurring debit card purchases and any time you pay a bill using the Wells Fargo online bill pay option. In addition, Wells Fargo automatically waives the monthly fee for account holders under the age of 24. Yes, Wells Fargo has 24/7 customer service available by phone and online.Is Wells Fargo a commercial bank?

Yes, Wells Fargo provides commercial banking services and products for individuals and businesses.What states have Wells Fargo banks? Wells Fargo's dealer services provide indirect auto financing, commercial products and banking services to auto dealers.How old do you have to be to open a bank account at Wells Fargo? You can open a Wells Fargo account with a parent or guardian at 13 years old. You must be at least 18 years old to open an account on your own. These guys are the best banking institution we have ever worked with. They protect your account fiercely and provide you the tools to manage your money wisely.

Additionally they have removed fees throughout the years that many other institutions continue to charge. They have embraced modern security solutions such as the as yet cracked AES encryption methods on your bank transactions and easily forgive overdraft fees, especially when you put money into your account the within a day or so. Local branches have personal touches and staff that don't push you to do anything at all.

They will however give you the options if you ask for them so you don't have to go looking for them. We will not charge a fee unless the transfer/advance covered at least one pending item, or helped you avoid at least one overdraft or returned item. The transfer/advance fee depends on the account type you have linked to your checking account for Overdraft Protection. We will charge the transfer/advance fee to your checking account when we transfer/advance funds from your savings or home equity line of credit account. If we advance funds from your credit card, we will charge the fee to your credit card.

Charges may apply, however, for the Wells Fargo Same Day Payments ServiceSM. Please refer to our fees page for fees associated with our online services. Account fees (e.g. monthly service, overdraft) may also apply to your account that you make Bill Pay payments from. Please refer to the Account Agreement, including the Fee and Information Schedule, applicable to your account. If you don't have a Wells Fargo credit card yet, learn more about all our credit card products and you can request to transfer a balance when you apply. All credit cards are subject to credit qualification. Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply.

Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. Wells Fargo Online Wires are unavailable through a tablet device using the Wells Fargo Mobile® app. To send a wire, sign on at wellsfargo.com via your tablet or desktop computer, or sign on to the Wells Fargo Mobile app using your smartphone. For more information, view the Wells Fargo Wire Transfers Terms and Conditions.

Scharf noted that a 2016 consent order imposed by the Consumer Financial Protection Bureau over Wells Fargo's retail sales practices recently expired. That order required Wells Fargo to pay a $100 million fine and provide restitution to customers who were assessed fees and other charges when the bank opened deposit and credit card accounts without their knowledge or consent. While it is relatively easy to avoid the monthly fee, make sure you're aware of the other charges you may face, including a $2.50 out-of-network ATM fee and a $35 overdraft fee if you overdraw your account.

If you sign up for Overdraft Protection with a linked savings account, you can avoid the painful $35 fee, but you will still have to pony up a $12.50 transfer fee when the money moves from savings to checking. You can assign view-only account access to anyone who needs it — your bookkeeper, accountant, other key employees — up to 25 people. You maintain security and control, because you choose which individuals to add and which accounts they can see.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.